Why Your Medical Reserve Could Be Costing You More Than Illness

You save for retirement, cut daily expenses, and plan your investments—yet one hidden flaw could silently drain your medical reserve. I learned this the hard way when a routine health scare exposed gaps in my strategy. It wasn’t the treatment cost that shocked me, but the preventable overspending. In this article, I’ll walk you through the real pitfalls people face when building a medical fund, and how simple cost-optimization choices can protect your savings without sacrificing care quality. Many assume that setting aside money for health is enough, but without a clear strategy, even substantial savings can vanish quickly. The truth is, how you manage your medical reserve matters as much as how much you save.

The Hidden Trap in Your Medical Reserve

At first glance, building a medical reserve seems straightforward: set aside funds to cover future health costs. Yet this seemingly sound approach often fails because it treats medical expenses as a single, predictable category, when in reality they are complex, evolving, and highly individual. The most common trap is equating medical savings with emergency cash—money stashed away for a sudden hospitalization or surgery. While such events are certainly costly, they are also relatively rare. The real financial drain comes from the accumulation of smaller, ongoing expenses that few plan for adequately. This mismatch between expectation and reality can erode savings faster than anticipated, leaving retirees vulnerable despite their best efforts.

Consider the case of a retired teacher who saved $50,000 specifically for medical needs, believing it would last well into her 80s. By age 72, the fund was nearly depleted—not due to a catastrophic illness, but because of recurring costs like specialist visits, lab work, and physical therapy for chronic joint pain. Her insurance covered only a portion, and she had not accounted for annual out-of-pocket increases. This scenario is far from unique. A 2023 report from the Employee Benefit Research Institute found that a 65-year-old couple retiring today may need between $315,000 and $440,000 to cover healthcare expenses throughout retirement, excluding long-term care. Yet most households have significantly less set aside, and even those who do often fail to structure their reserves effectively.

The problem lies in mindset. When people treat medical savings like a generic emergency fund, they overlook the need for strategic allocation. Unlike a car repair or home leak, health expenses are not one-time shocks but a continuous flow of payments that evolve with age and condition. Without a plan that anticipates these shifts, savings become reactive rather than proactive. For example, failing to budget for preventive screenings can lead to late-stage diagnoses with much higher treatment costs. Similarly, not planning for prescription inflation means being unprepared when medication prices rise year after year. The result is a reserve that feels secure at first but collapses under the weight of predictable, preventable expenses.

To avoid this trap, it’s essential to shift from a static savings model to a dynamic financial plan. This means mapping out anticipated health needs by decade, factoring in insurance coverage gaps, and adjusting for inflation in medical services. It also means recognizing that a medical reserve is not just about having money, but about deploying it wisely. A well-structured reserve includes designated allocations for prescriptions, outpatient care, and potential long-term support, ensuring that funds last as long as they’re needed. By treating healthcare as a long-term financial commitment—not just a safety net—retirees can protect their savings and maintain control over their health decisions.

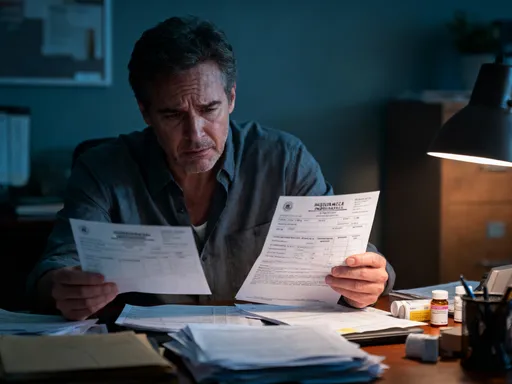

Overinsuring: When Protection Becomes a Burden

In the quest for security, many retirees fall into the trap of overinsuring their health. The logic seems sound: more coverage equals more protection. But in practice, stacking multiple insurance policies often leads to redundant benefits and unnecessary expenses. This overprotection may feel reassuring, but it comes at a cost—both in monthly premiums and lost opportunity for better financial allocation. The reality is that not all coverage is additive; some plans overlap significantly, paying for the same services without increasing overall value. When this happens, retirees end up paying twice for the same protection, draining resources that could be used for care, travel, or family support.

Take, for example, the common combination of a Medicare Advantage plan and a supplemental Medigap policy. While both aim to reduce out-of-pocket costs, they are not designed to be used together. Enrollees who mistakenly carry both may find that one plan pays what the other already covers, resulting in no additional benefit but higher combined premiums. Similarly, some retirees maintain employer-sponsored retiree health plans while also enrolling in private prescription drug plans (Part D), not realizing that both may offer overlapping medication coverage. These overlaps are often hidden in dense policy language, making it difficult for consumers to spot inefficiencies without careful review.

The financial impact of overinsurance accumulates silently. A retiree paying $250 per month for a Medigap plan and another $40 for a Part D plan may assume they are fully protected. But if their Medicare Advantage plan already includes drug coverage and low copays for hospital visits, much of that spending is redundant. Over ten years, that adds up to more than $35,000 in avoidable premiums. These are funds that could have been redirected toward home modifications for aging in place, travel, or even a dedicated fund for future long-term care. The irony is that the very effort to minimize risk ends up creating a new financial burden.

Avoiding overinsurance requires a clear understanding of what each plan covers and where duplication occurs. The first step is to conduct a comprehensive review of all health-related policies, including Medicare Parts A, B, C, and D, supplemental plans, and any retiree benefits. This should be done annually, as plan designs and formularies change. It’s also wise to consult a licensed insurance advisor who specializes in Medicare, as they can identify overlaps and recommend leaner, more cost-effective combinations. In some cases, switching to a single, well-chosen Medicare Advantage plan with built-in drug coverage and low out-of-pocket maximums can provide ample protection at a fraction of the cost. The goal is not to go underinsured, but to be intelligently insured—maximizing value while minimizing waste.

Underestimating Outpatient and Chronic Care Costs

When people think of medical expenses, hospital stays and surgeries often come to mind—dramatic, high-cost events that dominate headlines and insurance claims. But the true financial pressure in retirement comes from a quieter source: outpatient care and chronic disease management. These services—routine doctor visits, lab tests, imaging, physical therapy, and ongoing medication—are frequent, often lifelong, and only partially covered by insurance. Because they lack the shock value of an emergency, they are routinely underestimated in financial planning, yet their cumulative cost can exceed that of a hospitalization over time.

Chronic conditions like diabetes, hypertension, arthritis, and heart disease affect the majority of adults over 65. Managing these conditions requires consistent care, often involving multiple specialists, regular blood work, and daily medications. A person with type 2 diabetes, for instance, may see an endocrinologist every three months, undergo A1C testing, foot exams, eye screenings, and take insulin or oral medications. Even with insurance, copays, deductibles, and coinsurance add up. According to the American Diabetes Association, the average annual cost of diabetes care in 2022 was $19,700 per person—nearly double that of someone without the condition. Over a decade, that’s close to $200,000 in additional spending, much of it recurring and predictable.

What makes this particularly challenging is that standard health plans often provide limited coverage for outpatient services. Medicare, for example, typically covers 80% of approved costs for doctor visits and tests after the deductible is met, leaving beneficiaries responsible for the remaining 20%. There is no annual out-of-pocket maximum in traditional Medicare, meaning costs can rise indefinitely. A single year of frequent monitoring and treatment could result in thousands of dollars in uncovered expenses. Many retirees are unaware of this gap until they receive their first major bill, by which point their medical reserve is already under strain.

The solution lies in proactive planning. Rather than waiting for costs to accumulate, retirees should estimate their likely outpatient needs based on current health status and family history. This includes projecting the frequency of visits, expected tests, and medication needs over the next five to ten years. Once these are mapped, they can be integrated into the medical reserve as a recurring budget line, much like housing or utilities. Additionally, enrolling in a Medicare Advantage plan with an out-of-pocket maximum can provide a financial ceiling, protecting against runaway costs. Some plans also offer wellness programs that reduce copays for preventive services, further lowering long-term spending. By treating chronic care as a predictable expense rather than an emergency, retirees can allocate funds more efficiently and avoid surprise depletion of their reserves.

The Prescription Trap: Brand Loyalty vs. Smart Substitutions

One of the most common yet overlooked areas of overspending in retirement is prescription medication. Many retirees stay on brand-name drugs for years, believing they are safer or more effective, when in fact generic alternatives offer the same therapeutic benefits at a fraction of the cost. The U.S. Food and Drug Administration requires that generics have the same active ingredients, dosage, and performance as their brand-name counterparts. Yet misconceptions persist, leading to unnecessary spending that quietly drains medical reserves. A single brand-name drug can cost hundreds of dollars per month, while its generic equivalent may be available for less than $10—with identical medical outcomes.

The issue is compounded by the complexity of pharmacy benefit management. Insurance plans use formularies—lists of covered drugs—that categorize medications into tiers with different cost levels. Brand-name drugs often fall into higher tiers, requiring larger copays or coinsurance. Some plans even place certain generics in lower tiers but still charge more if the patient does not opt for them. Without understanding this structure, retirees may unknowingly choose more expensive options. For example, a patient taking a brand-name statin for cholesterol control might pay $50 a month, while a generic version of the same drug costs $8 and is equally effective. Over five years, that difference amounts to more than $2,500 in avoidable expenses.

Pharmaceutical marketing also plays a role. Direct-to-consumer advertising reinforces brand loyalty, making patients hesitant to switch even when advised otherwise. Some worry that generics are lower quality, though studies consistently show they are just as safe and effective. The key is to have open conversations with healthcare providers about medication choices. Doctors can often prescribe generics by default or switch patients when appropriate. Pharmacists can also offer guidance on available alternatives and help navigate formulary restrictions.

To reduce prescription costs, retirees should take several steps. First, review all current medications with a doctor or pharmacist to identify potential generic substitutions. Second, use the plan’s online formulary tool to compare costs before filling prescriptions. Third, consider mail-order pharmacy programs, which often offer lower prices for 90-day supplies. Finally, look into prescription assistance programs offered by drug manufacturers or nonprofit organizations, especially for high-cost medications. These strategies can lead to substantial savings without compromising health, preserving more of the medical reserve for truly unpredictable needs.

Insurance Gaps That Drain Your Fund

Even with comprehensive health coverage, retirees often face significant out-of-pocket expenses because certain essential services are not fully covered. Vision, dental, hearing, and mental wellness care are frequently excluded or minimally covered by standard Medicare and many supplemental plans. As a result, retirees pay for these services entirely out of pocket, slowly depleting their medical reserves without realizing the long-term impact. These gaps may seem minor individually—a $200 eye exam, a $300 dental cleaning, or a $1,500 hearing aid—but they add up quickly, especially when needed regularly or for both partners in a couple.

Take dental care, for instance. Medicare does not cover routine dental services such as cleanings, fillings, or dentures. Yet oral health is closely linked to overall well-being, with poor dental hygiene increasing the risk of heart disease and diabetes complications. Without insurance, a full set of dentures can cost between $1,500 and $8,000, and major procedures like root canals or implants can exceed $3,000. Many retirees delay care due to cost, leading to more serious (and expensive) problems later. Similarly, standard plans often cover only basic hearing exams, not the cost of hearing aids, which can range from $1,000 to $3,000 per ear. With nearly 30 million U.S. adults over 65 experiencing hearing loss, this is a widespread and costly gap.

Vision care is another area of undercoverage. While Medicare covers some eye exams for diabetics and cataract surgery, it does not pay for routine eye exams, glasses, or contact lenses. For retirees who rely on corrective lenses, this means annual expenses that are predictable but unfunded. Mental wellness services, though increasingly recognized as essential, are also often limited in coverage. Many plans impose strict session limits or require high copays for therapy, discouraging consistent care. Yet untreated anxiety or depression can worsen physical health and increase medical utilization, creating a cycle of higher overall costs.

To address these gaps, retirees should evaluate their needs and explore supplemental options. Stand-alone dental and vision plans are available through private insurers and Medicare Advantage plans, often at affordable monthly premiums. Some dental discount programs offer reduced rates for members without traditional insurance. For hearing aids, certain states and nonprofit organizations provide financial assistance or low-cost devices. Additionally, using flexible spending accounts (FSAs) or health savings accounts (HSAs) before retirement can allow tax-free withdrawals for these expenses. By planning ahead and closing coverage gaps, retirees can protect their medical reserve from unexpected but necessary spending.

How Timing and Care Settings Affect Spending

The cost of medical care is not fixed—it varies significantly based on when and where services are received. A routine MRI, for example, can cost anywhere from $400 at an independent imaging center to over $1,200 at a hospital-owned facility, even when the same equipment and radiologist are used. Similarly, a minor procedure performed in a hospital outpatient department may be billed at a much higher rate than the same service in a freestanding clinic. These differences are not always apparent to patients, who often accept the first available appointment without considering cost implications. Yet making informed choices about timing and location can lead to substantial savings over time.

Timing also plays a crucial role. Delaying preventive care—such as colonoscopies, mammograms, or diabetes screenings—may save a small amount in the short term but often leads to more serious and expensive conditions later. Early detection of cancer, for instance, can reduce treatment costs by tens of thousands of dollars compared to late-stage intervention. Similarly, managing blood pressure and cholesterol proactively can prevent heart attacks and strokes, which carry average hospitalization costs exceeding $20,000. Preventive care is typically covered at 100% under Medicare and most insurance plans, making it one of the most cost-effective health investments available.

Another factor is care coordination. Seeing multiple specialists without a primary care provider overseeing treatment can lead to duplicate tests, conflicting medications, and unnecessary procedures—all of which increase costs and risks. A well-coordinated care plan, led by a trusted physician, ensures that services are necessary, timely, and appropriately priced. Patients can also use online cost transparency tools provided by insurers or employers to compare prices for common procedures in their area. Some plans even offer incentives for choosing lower-cost, high-quality providers.

By being strategic about when and where care is received, retirees can maintain high-quality treatment while controlling expenses. Scheduling preventive visits annually, choosing independent clinics for routine imaging, and using primary care providers to coordinate treatment are simple but powerful ways to protect the medical reserve. These decisions do not compromise health—they enhance it by promoting efficiency and sustainability in care delivery.

Building a Smarter Medical Reserve: A Balanced Approach

The goal of a medical reserve is not to eliminate all health spending, but to ensure that funds are used wisely and sustainably. A well-structured reserve balances protection with efficiency, avoiding both underpreparation and overinsurance. It begins with a realistic assessment of current and future health needs, incorporating chronic conditions, medication use, and family history into long-term projections. From there, retirees can allocate funds strategically, setting aside amounts for predictable outpatient costs, prescription inflation, and potential long-term care needs.

Insurance selection is a critical component. Rather than stacking multiple plans, retirees should aim for a streamlined, well-matched combination that covers essential services without redundancy. This may include a Medicare Advantage plan with integrated drug coverage and an out-of-pocket maximum, supplemented by targeted policies for dental, vision, and hearing if needed. Annual reviews ensure that coverage remains aligned with changing health and financial circumstances.

Cost-conscious habits also play a role. Switching to generic medications, using mail-order pharmacies, and choosing lower-cost care settings can yield significant savings over time. Preventive care should be prioritized, not postponed, as it is one of the most effective ways to avoid costly complications. Finally, retirees should track medical expenses annually to identify trends and adjust their reserve strategy accordingly.

A medical reserve is more than a financial account—it is a tool for peace of mind. When built with clarity and discipline, it allows retirees to access the care they need without fear of financial ruin. By focusing on smart allocation, informed choices, and long-term planning, it is possible to protect both health and wealth in equal measure. The true value of a medical reserve lies not in its size, but in its sustainability—ensuring that every dollar spent contributes to a healthier, more secure future.